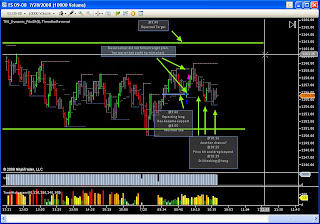

Why price stall below the line?

4 types of ppl in the market.

1. Those that've shorted the break out weeks back : worry of turning a winner to looser, buy to BE.

2. Those holding long position @ this support level weeks back : buyers who purchase near a support level, only to see price fall, are likely to sell in order to recover their losses, when price rallies to near their break-even point.

3. Those holding long position @ lower level : seeing S turn R, will sell to take profit

4. Those not in trade : with the notion of Support becomes resistance, start to sell.

What's the relationship between price and S/R? These are key areas to look for. On hindsite we can tell how price react to earlier S/R. Question is how to trade them in real time?

What's the relationship between price and S/R? These are key areas to look for. On hindsite we can tell how price react to earlier S/R. Question is how to trade them in real time?