[20:29] *** Anek-L10-ES (~priv@r190-135-162-179.dialup.adsl.anteldata.net.uy) joined

[20:29] .Anek-L10-ES. Good evening all

[20:32] .herbertdotcom-L1. sup Anek

[20:33] .herbertdotcom-L1. hows it going??

[20:34] .Anek-L10-ES. hey H how are you

[20:34] *** [1]jfw215 (~jfw215@c-98-234-149-71.hsd1.ca.comcast.net) joined

[20:34] .Anek-L10-ES. all good here

[20:34] .herbertdotcom-L1. alright. still trying to become profitable

[20:34] .Anek-L10-ES. ya, that crap takes time man :(

[20:35] .herbertdotcom-L1. ya, not stopping until im there

[20:35] .Anek-L10-ES. agree, only real defeat is when you quit

[20:35] .herbertdotcom-L1. ive been trying to use the 5 sec lately. particularly tricky heh

[20:36] .Anek-L10-ES. I wouldnt touch it, until you truly understand the 1min/vol

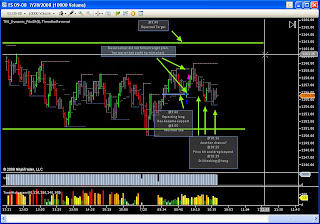

[20:36] .Anek-L10-ES. If you open the 1 min for today

[20:36] .Anek-L10-ES. you could have seen the volume divergence at the DTOP in the morning

[20:36] .Anek-L10-ES. and in the afternoon reversal

[20:37] .Anek-L10-ES. it was going up on high volume

[20:37] .Anek-L10-ES. and all retracements on low volume

[20:37] .Anek-L10-ES. sign of momentum to come

[20:37] .Anek-L10-ES. 5 sec offers some "edges" because its faster

[20:37] .Anek-L10-ES. but if you dont master the 1 min, its going to end up hurting you

[20:37] .herbertdotcom-L1. ya i need to get better at reading vol. period

[20:38] .herbertdotcom-L1. getting a little better at spotting divergences and what high and low vol is

[20:38] .Anek-L10-ES. when you have reversal pattern

[20:38] .Anek-L10-ES. say

[20:38] .Anek-L10-ES. double top

[20:38] .Anek-L10-ES. double bottom

[20:38] .Anek-L10-ES. 2B

[20:38] .Anek-L10-ES. W

[20:38] .Anek-L10-ES. that sort of thing

[20:39] .Anek-L10-ES. you want the 1st leg

[20:39] .herbertdotcom-L1. congrats on L10 btw =]

[20:39] .Anek-L10-ES. to have exhaustion volume

[20:39] .Anek-L10-ES. hah!, just a #

[20:39] .Anek-L10-ES. real big volume bar

[20:39] .Anek-L10-ES. then the 2nd attemtp

[20:39] *** jfw215 quit (Ping timeout for jfw215[c-98-234-149-71.hsd1.ca.comcast.net])

[20:39] *** [1]jfw215 changed nick to jfw215

[20:39] .Anek-L10-ES. should have at most medium to little volume

[20:39] .Anek-L10-ES. if its at the top

[20:39] .Anek-L10-ES. it doesnt matter if the 2nd top is a HH

[20:39] .Anek-L10-ES. just has to be minimal vol in comparison to the 1st

[20:40] .Anek-L10-ES. means all the demand is over

[20:40] .Anek-L10-ES. and most of the stops were hunted

[20:40] .Anek-L10-ES. vice versa for the bottoms

[20:40] .Anek-L10-ES. 1st leg on exhaustive volume

[20:40] .Anek-L10-ES. 2nd leg on little volume

[20:40] .Anek-L10-ES. even if its a LL

[20:40] .Anek-L10-ES. just make sure its CONFLUENTIAL

[20:40] .Anek-L10-ES. something in the anchor supporting it

[20:41] .Anek-L10-ES. remember that price doesnt like to reverse just anywhere

[20:41] .Anek-L10-ES. mid air, doesnt make it happen

[20:41] .Anek-L10-ES. key areas do

[20:41] .Anek-L10-ES. and thats the confluence I look for

[20:41] .herbertdotcom-L1. ya confluence is key...like the close today, wished market was open longer so i could shot

[20:41] .CasperCRF. hey

[20:41] .herbertdotcom-L1. short

[20:41] .herbertdotcom-L1. where/when do you decide to enter when playing a reversal like this?

[20:41] .Anek-L10-ES. also dont confuse a pause in the trend with a reversal

[20:41] .Anek-L10-ES. hi Casper

[20:41] .Anek-L10-ES. sometimes when the trend has been very strong

[20:41] .Anek-L10-ES. it needs a pause

[20:41] .Anek-L10-ES. a rest

[20:42] .Anek-L10-ES. thats when amateurs start looking for reversals

[20:42] .Anek-L10-ES. and weak shorts

[20:42] .Anek-L10-ES. start covering

[20:42] .Anek-L10-ES. assumign it was a downtrend

[20:42] .Anek-L10-ES. then it will dance around a range

[20:42] .Anek-L10-ES. even make you think it did a Higher High

[20:42] .Anek-L10-ES. but in truth is just consolidated

[20:42] .herbertdotcom-L1. in the middle of nowhere

[20:42] .Anek-L10-ES. this is perfect time

[20:42] .Anek-L10-ES. to re-short the upper range of the range

[20:42] .Anek-L10-ES. for the second leg down

[20:42] .Anek-L10-ES. rarely and I mean very rarely

[20:42] .Anek-L10-ES. does price reverse off a consolidation channel

[20:43] .Anek-L10-ES. its usually

[20:43] *** Stavros-L3|SimES (~stavros@d149-67-86-153.col.wideopenwest.com) joined

[20:43] .Anek-L10-ES. DT, DB, H and S, M, W, I H and S

[20:43] .herbertdotcom-L1. lunch yesterday an exampe of this right

[20:43] .Anek-L10-ES. not a tube

[20:43] .Anek-L10-ES. well lunch is notorious for consolidation

[20:43] .Anek-L10-ES. all volume dries up

[20:43] .Anek-L10-ES. and price just flies thru a channel

[20:44] .Anek-L10-ES. Im just saying consolidation after a trend, usually means

[20:44] .Anek-L10-ES. pause until the 2nd leg

[20:44] .Anek-L10-ES. and consolidation is consolidation, not reversal

[20:44] .Anek-L10-ES. and dont forget that reversals must be confirmed

[20:44] .Anek-L10-ES. just because it has two identical legs at support

[20:44] .Anek-L10-ES. doesnt mean its a DB

[20:45] .Anek-L10-ES. until the S is broken it will look like a DB

[20:45] .Anek-L10-ES. always

[20:45] .herbertdotcom-L1. ya

[20:45] .Anek-L10-ES. and just because it paused

[20:45] .Anek-L10-ES. doesnt mean it will hold

[20:45] .Anek-L10-ES. usually you want that mid point to do a magic tick

[20:45] .Anek-L10-ES. and the retracements

[20:45] .Anek-L10-ES. to make HLs

[20:45] .Anek-L10-ES. then you migth have something

[20:45] .Anek-L10-ES. assumign the DB is at a confluential point

[20:46] .Anek-L10-ES. anyway, good trading to all

[20:46] .Stavros-L3|SimES. that "W" at 2:00 was a perfect example of reaction and not prediction

[20:46] .Anek-L10-ES. take care H

[20:46] .Anek-L10-ES. right

[20:46] .herbertdotcom-L1. if the first leg of a DB has exhaustin vol, and the next leg is falls with light vol, can u enter on a HL?

[20:46] .Anek-L10-ES. cay Casper

[20:46] .Anek-L10-ES. cya

[20:46] .CasperCRF. cya

[20:46] *** Anek-L10-ES (~priv@r190-135-162-179.dialup.adsl.anteldata.net.uy) left ()